New Benchmark Analysis of U.S. Banks Reveals Inconsistencies Between Climate Goals and Climate Lobbying Practices

August 24, 2023 /3BL/ - A new benchmark analysis of 13 of the largest banks operating in the United States reveals significant inconsistencies between the banks’ public climate commitments and their direct and indirect climate lobbying practices.

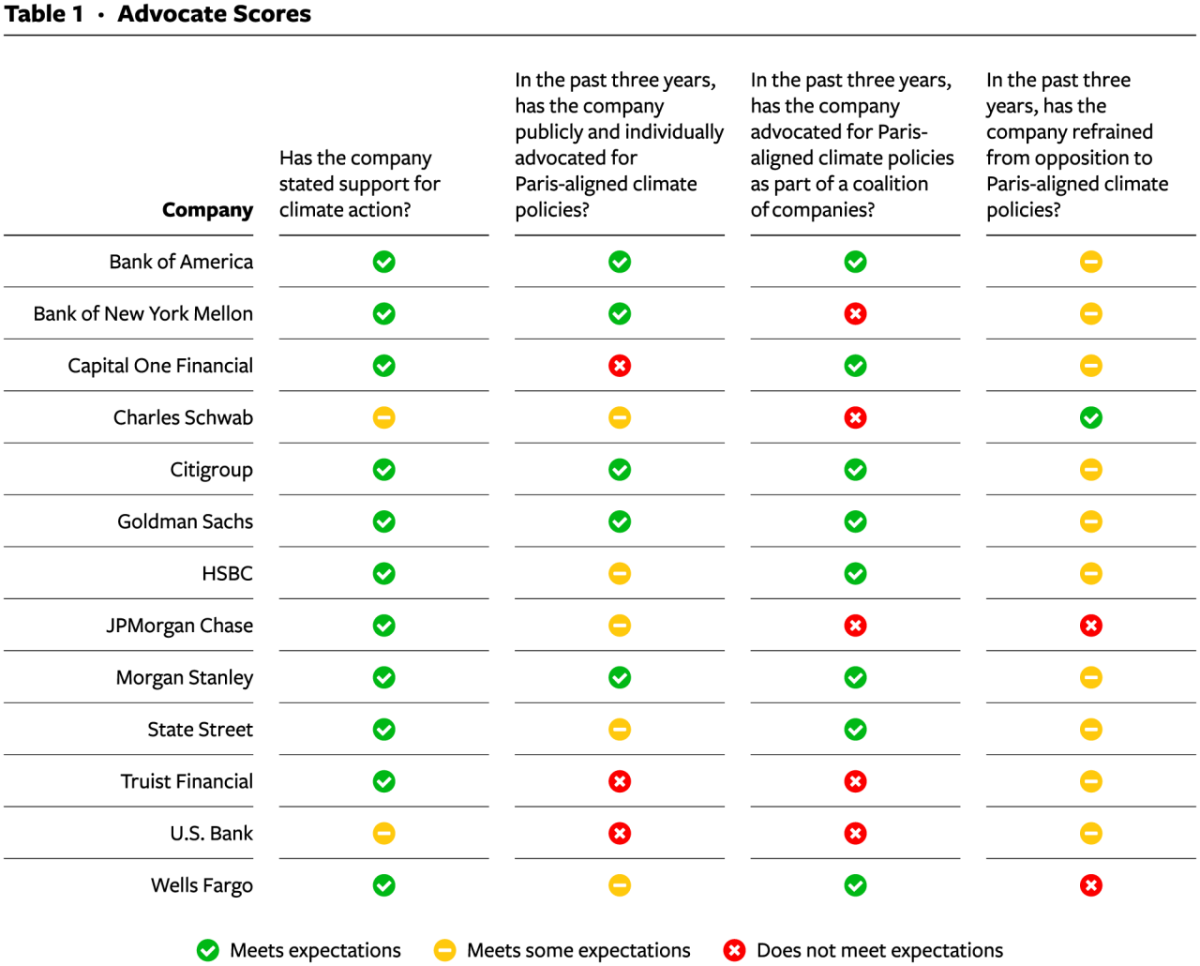

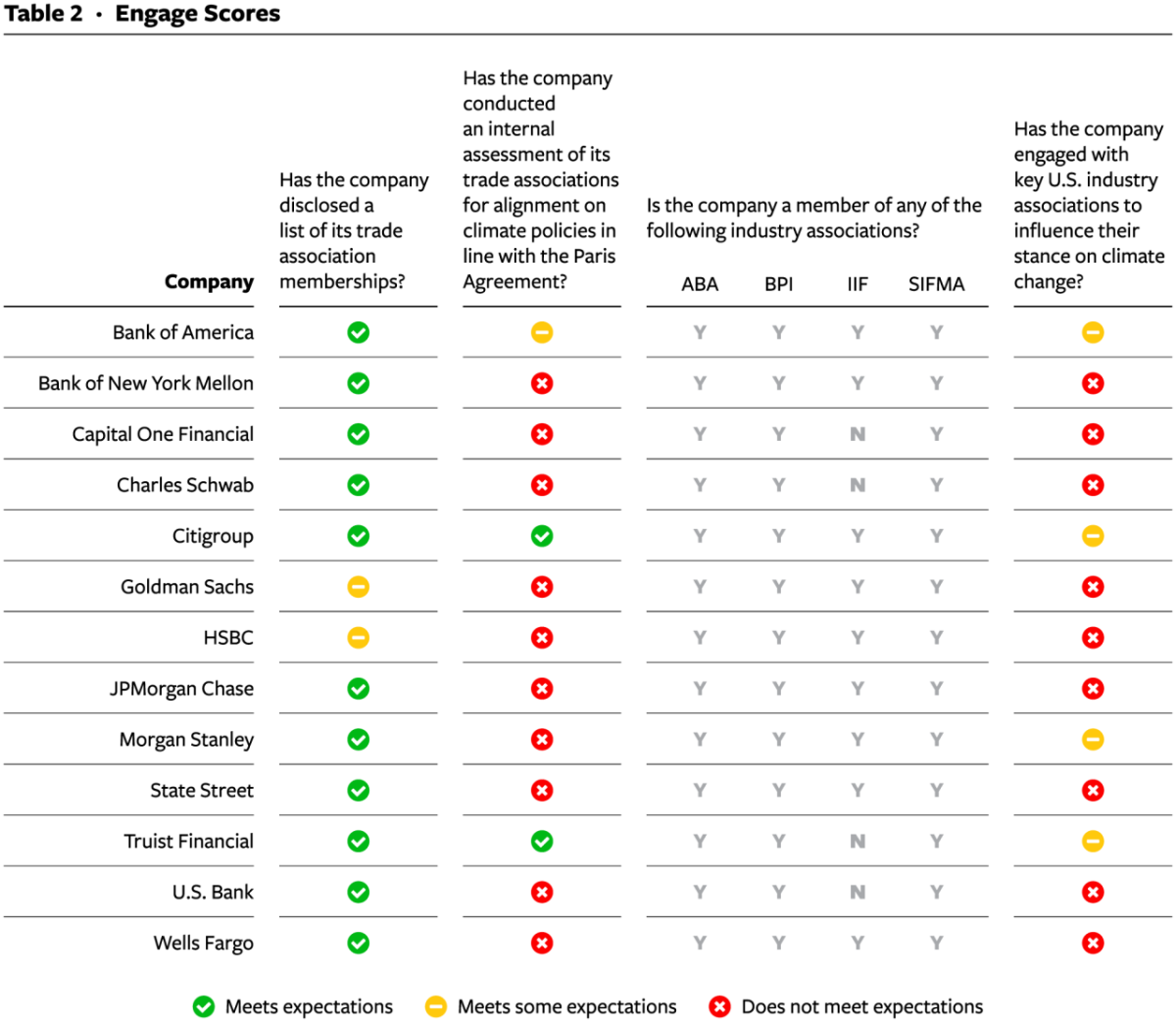

The Responsible Policy Engagement Benchmarking for Banks shows that despite banks’ public endorsement of the Paris Agreement's goals and pledges to align their lending and investments with net zero emissions by 2050 or even earlier, the banks’ lobbying practices do not match their stated support for Paris-aligned policies and regulations with 92% of banks advocating against or pushing back on Paris-aligned climate policies in the last three years. In addition, an astounding 75% of the banks analyzed lobbied both for and against Paris-aligned policies, highlighting the banks' conflicting approach to climate policy engagement.

“Banks play an essential role in ensuring the nation meets its goals for cutting greenhouse gas emissions in half by the end of this decade and limiting global temperature rise to no more than 1.5-degrees Celsius,” said Steven Rothstein, managing director of the Ceres Accelerator for Sustainable Capital Markets at Ceres. “Too few banks are meaningfully engaging with policymakers in alignment with their net zero goals. As banks continue to face increasing exposure to climate-related financial risks, it is critical that they use their policy advocacy resources to support and advocate for policies that reduce these risks and support the transition to a clean energy economy.”

Notably, every bank assessed in the analysis publicly acknowledges the reality of climate change and the need for policies to address climate risk and meet U.S. emissions reduction goals. However, banks have also been slow to take advantage of recent Paris-aligned advocacy opportunities, such as the passing of the Inflation Reduction Act, the largest and most significant climate investment legislation in U.S. history. Less than half of the banks in the benchmark (5 out of 13) advocated independently in favor of specific climate policies and not a single bank publicly supported the Inflation Reduction Act prior to its passing. Though, Bank of America, Citi, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo, among others, encouraged their clients to take advantage of the implementation opportunities in the legislation.

“Corporate advocacy for science-based climate policy can unlock significant investment and deliver action at scale,” said Dominic Gogol, Deputy Director of Policy for the We Mean Business Coalition. “Ceres has pioneered the concept of responsible policy engagement on climate change for corporations, and the new analysis on the U.S. banking sector takes the application of responsible policy engagement to the next level – offering new insight and providing clear guidance for large banks. This kind of sector-specific analysis of corporations’ track record on climate change, trade association positions and relevant policy opportunities for engagement enables companies to close the gap between their climate ambition and advocacy.”

“Climate risk is increasingly important for financial institutions, and banks can no longer afford to remain passive regarding climate policy. This includes holding themselves and their trade associations accountable for their climate policy engagement,” said Blair Bateson, CFA, director of the Ceres Company Network at Ceres and co-author of the analysis. “Individual institutions can take actions to protect themselves, but what they can’t do without policy is minimize systemic risk to the banking system as a whole.”

The benchmark analysis recommends that banks advocate for policies that support borrowers in the shift to a decarbonized economy, and balanced regulation that de-risks climate finance, improves disclosure, and positions banks and clients for long-term success. Recognizing their influence, banks, especially larger institutions, should also take an active role in proactive climate action to positively impact both greenhouse gas trajectories and global economic stability.

Aligned with these recommendations, Ceres' Ambition 2030 initiative focuses on six key sectors, including banking, with the aim of decarbonizing the highest emitting industries by driving greater corporate climate action. These sectors, which also include electric power, food, agriculture, oil and gas, steel, and transportation, contribute to about 80% of total U.S. emissions based on 2019 data from the Environmental Protection Agency. Responsible policy engagement consistent with climate science is an essential expectation of companies in these sectors.

The Responsible Policy Engagement Benchmarking for Banks was released by the Ceres Accelerator for Sustainable Capital Markets and builds off of the 2022 Responsible Policy Engagement Benchmark, which examined the climate-related risk management, governance, and lobbying practices of S&P 100 companies.

About Ceres

Ceres is a nonprofit organization working with the most influential capital market leaders to solve the world’s greatest sustainability challenges. The Ceres Accelerator for Sustainable Capital Markets is a center of excellence within Ceres that aims to transform the practices and policies that govern capital markets to reduce the worst financial impacts of the climate crisis. It spurs action on climate change as a systemic financial risk—driving the large-scale behavior and systems change needed to achieve a net-zero emissions economy through key financial actors including investors, banks, and insurers. The Ceres Accelerator also works with corporate boards of directors on improving governance of climate change and other sustainability issues. For more information, visit ceres.org and ceres.org/accelerator and follow @CeresNews.

Media contact:

Diane May, Ceres

dmay@ceres.org