Beat the Heat With Cool Buying Strategies for Summer

Originally published on NRG Energy Insights

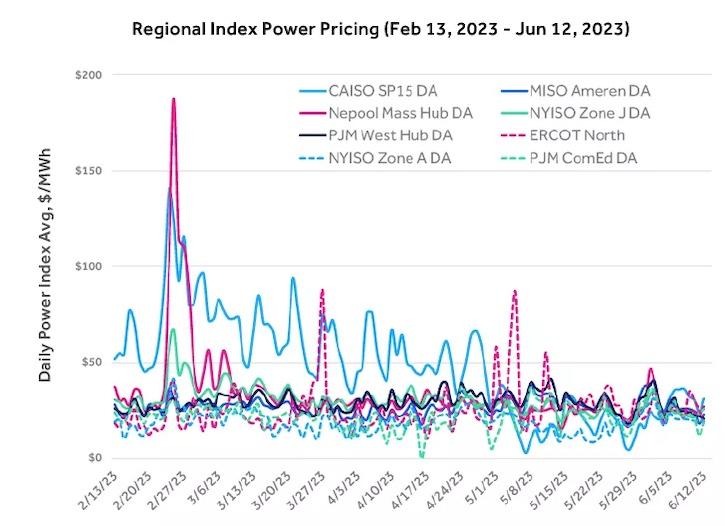

Summer is here and depending on where you’re at with your energy buying strategy, you may be hoping for cooler days ahead. If you don’t have long-term plans in place and are currently riding the (sometimes) wild waves of summer market prices, here is a quick update on market fundamentals and some approaches to consider for your buying strategy now that we’re in the thick of the hot season.

The bulls and the bears

There are obviously a lot of factors impacting the market—each of which could put potential upward or downward pressure on near-term prices. Let’s have a look:

Weather

How is summer weather this year compared to last? When the heat moves up, so does the demand for power, therefore having some insight into the weather can help predict what could happen with electricity prices.

Bearish factors

After three full years in La Niña conditions, the El Niño Southern Oscillation (ENSO) region saw strong warming trends this spring then rapidly pushed into neutral-positive territory, with a likelihood of pushing into positive territory.

El Niño conditions mean summer 2023 may favor a warm, dry north and a cooler/wet south and fewer Atlantic hurricanes.

Bullish factors

Since 2000, summers on average have been trending warmer. In addition, even a cooler/wetter summer has the potential for periods of prolonged heat.

Natural gas

Power markets can be closely correlated with the natural gas market since natural gas is a key power generation source in most regions. In ERCOT, natural gas is the marginal generation unit that is dispatched, which sets the price in the real-time market, so power pricing trends directionally with gas. Understanding gas fundamentals can provide insight into power price trajectory.

Bearish factors

Since the sharp falloff just prior to the start of last year, natural gas production has grown, currently averaging 5 Bcf/day higher year-to-date compared to the same time last year. According to the EIA, we currently sit at a storage surplus compared to last year and the 5-year average.

Total U.S. demand January-February 2023 trended quite a bit lower than last year’s average for the same period due to warmer-than-average temps across most regions of the country. Near-term prices dropped significantly, with the recent bottom set at the end of February.

Bullish factors

Though the market is well-supplied and near-term gas prices reflect that, bullish factors include slowing production growth due to producers’ sentiments about production costs being above current NYMEX pricing. Also, the increased demand in liquefied natural gas (LNG) exports coming down the curve will further link North America to higher global pricing. Lower production and increased exports would rebalance the market to a higher level. As demand necessitates new production down the road, it may come at a higher cost from inflationary pressures and escalating extraction costs.

These bullish factors are reflected in the contango curve—near-term gas prices are lower and longer-term prices are higher.

Regional factors

CAISO

California saw large withdrawals from gas storage due to an elongated winter, with below-normal temperatures persisting into mid-April. Although there have been injections into storage and levels are improving, they’re trailing last year and the 5-year average. Gas is used as a reliable, dispatchable fuel to generate power, particularly during times of heightened demand in the summer.

Bearish factors

Hydro power is projected to be very healthy this year, which could offset some of the power burn demand for gas, but supply/demand, and thus pricing, will all be dependent on the weather.

Bullish factors

If gas storage remains low, this could add price support for both gas and power prices, particularly during warmer-than-normal summer conditions.

PJM & MISO

Bearish factors

If cooler weather prevails, volatility from sustained hot temperatures could be averted.

Bullish factors

There is a focus on power plant retirements due to higher regulatory costs, higher priced coal, and low-capacity auction results. As these plants retire, peaker plants and higher-priced generation assets may be needed to meet the load during high demand periods — which can drive prices higher.

Stagnant regional natural gas production can also put pressure on power prices in this region.

New generation focuses on renewables, which are intermittent and can therefore cause a risk to the supply/demand mix.

NYISO & NEISO

Bearish factors

If cooler weather prevails, volatility from sustained hot temperatures could be averted.

Bullish factors

Besides facing generation plant retirements, natural gas pipeline constraints also hinder bringing ample gas to the region for power generation.

Upstate New York faces transmission constraints and downstate faces higher capacity prices due to demand.

ERCOT

Natural gas is the marginal generation unit dispatched in ERCOT that sets real-time electricity prices. Load is forecasted to be higher this summer with more renewables and flat reserve margins compared to summer 2022.

Bearish factors

With gas prices being lower now than last summer, so too were historical July-August '23 peak prices leading into the summer.

If El Niño conditions are present and cooler and wetter weather prevails, actual demand could be lower and long periods of sustained high temperatures could be tempered.

Bullish factors

Real-time grid conditions will be closely correlated to the real-time performance of renewables, such as wind and solar, which are intermittent.

Supply growth during the afternoons is expected to outpace peak demand, while demand growth is expected to outpace supply growth during non-solar hours. This implies the tightest hours of the grid will shift away from HE17 toward HE21 at sunset when reserve margins are much tighter. With a larger percentage of non-dispatchable operating reserves, there may be a higher likelihood for scarcity pricing going forward.

Buying considerations

If you’re waiting to lock in near-term prices or riding the index market, then you are probably pleased with your strategy based on depressed forward and index prices. A 12-month contract starting in July 2023 may have been more expensive last year than it is now but be careful, as summer weather can shift quickly and drive both index and forward prices higher.

With a contango curve shape for both gas and power forwards, longer-term hedges may not reflect as much value as shorter-term deals — but don’t ignore the more bullish fundamentals outlined above. Some ideas to consider:

- There may be a sweet spot for locking in your requirements now for a shorter to mid-length term.

- Consider a hybrid strategy whereby you can lock in some of your requirements to help protect your budget from full exposure to potential summer price volatility, while also having the opportunity to capitalize on lower market prices that may continue during the summer.

- For longer-term purchases, consider that while the contango market doesn’t provide discounts by going long-term, you may still be able to lock in a year-over-year rate decline, depending on your previous contract terms.

Consult with your NRG Account Executive on pricing and terms for your region and specific usage requirements so that you can make the best decision for your business.

NRG Energy, Inc. (along with our affiliates, “NRG” or “we”) makes no representation or warranty, express or implied, as to the accuracy or completeness of the information set forth in this document, and we shall not have any liability to any person or entity resulting from use of this information in any way. This information is provided for informational purposes only, and it is not (and it may not be construed as) an offer to enter into any transaction. In addition, this information is not (and it should not be viewed as) recommending or advising on a particular result, strategy, or trading decision in any market.