The Impact of Climate Change on Women and What Investors Can Do

Climate-related issues such as water scarcity, natural disasters and access to electricity have a disproportionate effect on at-risk female populations. Here’s what investors can do.

Originally published on Morgan Stanley Insights

Climate change and gender equity are both top-of-mind sustainability topics for investors. More than 80% of asset owners surveyed currently invest to combat climate change or plan to do so, while close to half are investing, or planning to, in gender diversity, according to the Morgan Stanley Institute for Sustainable Investing’s latest Sustainable Signals report.

But many investors may not realize that the issues of climate change and gender equity are highly interconnected. Investors looking to address climate issues holistically, including funding a “just transition” to a low-carbon economy that is fair, inclusive and has decent work opportunities for everyone, should assess and consider targeting solutions at the intersection of climate-related issues and gender equity.

There are three specific areas in which interested investors can help tackle climate change and unlock opportunities for millions of women and girls worldwide:

- Water scarcity: In 2020, 1.7 billion people did not have a dedicated, safe water supply.1 This burden is worsening as climate change reduces the amount of available water due to drought, saltwater intrusion and the increasing runoff of pollutants and sediment.2 This has a disproportionate impact on women, who often carry the burden of collecting water for their households, taking them away from education or paid work.3

- Natural disasters: Women often take on additional caring responsibilities for those affected by natural disasters often catalyzed by a changing climate, increasing the time they spend on unpaid domestic labor.4 In addition, disruption following natural disasters is associated with higher rates of violence against women and girls. Examples include the 2010 Haiti earthquake and the 2011 Christchurch earthquake in New Zealand, after which there were reports of widespread rape and an increase in intimate partner violence.5

- Access to electricity: India illustrates one example of the obstacles that women and girls face when they don’t have reliable access to electricity. Grid limitations in India have hampered the transition from coal toward renewable energy sources, and as a result, women and girls are burdened with the collection of solid fuels for heating, lighting and cooking, taking time away from other activities.6 Globally, two million women and children die prematurely each year from illnesses related to indoor air pollution, primarily from cooking with solid fuels.7

How Investors Can Address Climate Change and Gender Equity

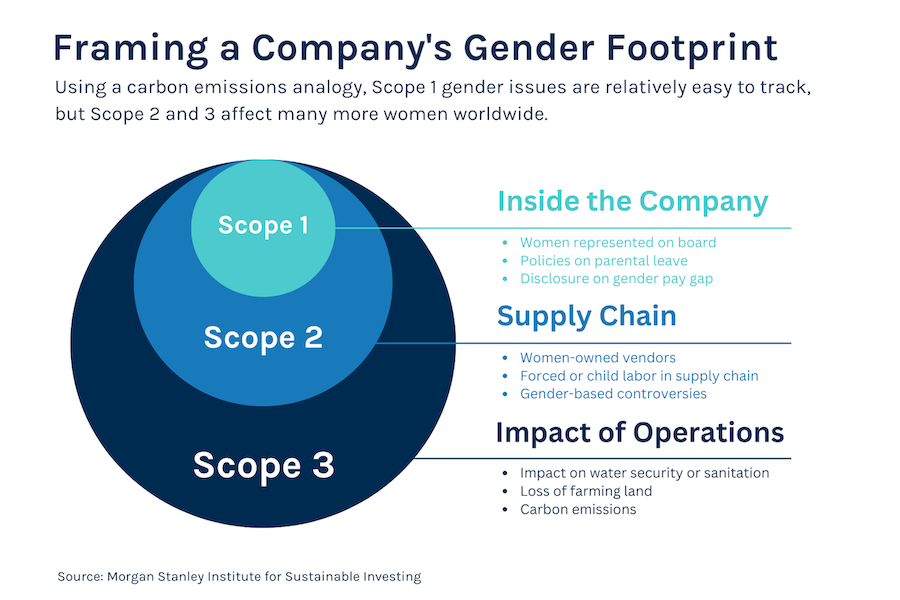

By assessing how their investments in climate-related issues might disproportionately affect at-risk female populations, investors have the potential to expand the breadth of their impact. One way for investors to do this is by considering what the Morgan Stanley Institute for Sustainable Investing calls “Scope 3” gender issues for companies, or the impact of a company’s operations on women and girls around the world.

For example, investments seeking to modernize grid infrastructure have a primary goal of enabling access to reliable and sustainable electricity to more people, while also reducing carbon emissions. But these investments also have the potential to reduce the time women and girls spend collecting solid fuels for the household, therefore providing more opportunities for paid work or education.

Framing a Gender Company's Footprint

Using a carbon emissions analogy, Scope 1 gender issues are relatively easy to track, but Scope 2 and 3 affect many more women worldwide.

*See chart above

Investors can use this framework above to map a company’s footprint on gender issues, while also identifying opportunities to invest on issues at the intersection of climate and gender, especially in the “Scope 3” category. In addition, institutional investors and self-directed retail investors can follow these best practices to address both gender equity and climate change in their investment strategies:

- Seek investments explicitly targeting climate-related issues affecting women.

- Consider how existing investments in climate change or water solutions may affect women specifically.

- Screen for gender metrics alongside water- and carbon-intensity metrics, especially for investors following exclusionary investing approaches.

- Ask companies operating in highly water- and/or carbon-intensive industries to quantify, and then reduce, their operational impact on at-risk female communities.

- Include gender issues in proxy voting guidelines or cooperate with third parties to raise the issue of gender in climate-related investments.

- Incorporate gender and climate considerations into investment belief statements or fund prospectuses.

Footnotes

1Progress on Household Drinking Water, Sanitation and Hygiene, 2000 – 2020, WHO/Unicef joint monitoring programme. Progress on household drinking water, sanitation and hygiene, 2000-2020: Five years into the SDGs - UNICEF DATA

2 https://www.epa.gov/arc-x/climate-adaptation-and-source-water-impacts

4 World Bank, Gender Dimensions of Disaster Risk and Resilience https://openknowledge.worldbank.org/bitstream/handle/10986/35202/Gender-Dimensions-of-Disaster-Risk-and-Resilience-Existing-Evidence.pdf?sequence=1&isAllowed=y

5 Natural hazards, disasters and violence against women and girls: a global mixed-methods systematic review. BMJ Global Health, May 2021 https://www.bmj.com/company/newsroom/natural-disasters-increase-triggers-for-violence-against-women-and-girls/

6 Supporting Just Transitions in India, March 2021, Climate Investment Fund Project_Report.pdf (teriin.org)

7 UNDP Linkages Gender and CC Policy Brief 1-WEB.pdf

Disclosures

This material was published on March 7, 2023, and has been prepared for informational purposes only, and is not a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed in this material may not be appropriate for all investors. It should not be assumed that the securities transactions or holdings discussed were or will be profitable. Morgan Stanley recommends that investors independently evaluate particular investments and strategies and encourages investors to seek the advice of a Financial Advisor.

This material contains forward-looking statements and there can be no guarantee that they will come to pass. Past performance is not a guarantee of future results or indicative of future performance.

Information contained in this material is based on data from multiple sources and Morgan Stanley makes no representation as to the accuracy or completeness of data from sources outside of Morgan Stanley.

Morgan Stanley makes every effort to use reliable, comprehensive information, but we make no guarantee that it is accurate or complete. We have no obligation to tell you when opinions or information in this material may change.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

The returns on a portfolio consisting primarily of Environmental, Social and Governance (“ESG”) aware investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because ESG criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. Diversification does not guarantee a profit or protect against loss in a declining financial market.

The guest speakers at the Sustainable Investing Summit are neither employees nor affiliated with Morgan Stanley & Co. LLC or Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Opinions expressed by the guest speakers are solely their own and do not necessarily reflect those of Morgan Stanley.

Information contained in the material is based on data from multiple sources and Morgan Stanley makes no representation as to the accuracy or completeness of data from sources outside of Morgan Stanley. References to third parties contained herein should not be considered a solicitation on behalf of or an endorsement of those entities by Morgan Stanley. Morgan Stanley is not responsible for the information contained on any third-party web site or your use of or inability to use such site, nor do we guarantee its accuracy or completeness. The terms, conditions, and privacy policy of any third-party web site may be different from those applicable to your use of any Morgan Stanley web site. The opinions expressed by the author of an article written by a third party are solely his/her own and do not necessarily reflect those of Morgan Stanley. The information and data provided by any third-party web site or publication is as of the date of the article when it was written and is subject to change without notice.

© 2023 Morgan Stanley & Co. LLC and Morgan Stanley Smith Barney LLC. Members SIPC.

CRC 5485190 03/2023