AllianceBernstein: Healthcare Pipelines and Paychecks - A Formula for Assessing Executive Pay

Bob Herr| Director of Corporate Governance

Ryan Oden| Co–Portfolio Manager and Senior Research Analyst—US Growth Equities

Our research suggests that firms with sound executive pay practices yield healthier returns.

Executive compensation plans are a useful tool for aligning the interests of management with those of shareholders. But we find that for pharmaceutical and biotechnology firms in particular, good incentives are critical. Our research points to better long-term investment outcomes for healthcare companies with better compensation practices.

Proxy Vote Prognosis

Every proxy season, companies across most markets slate their executive pay packages for shareholder approval. We leverage these votes as a tool to formally express our compensation philosophy. When we determine that a company’s pay structure fails to appropriately incentivize executives, we vote against it—something we’ve historically done more often than not in the healthcare sector.

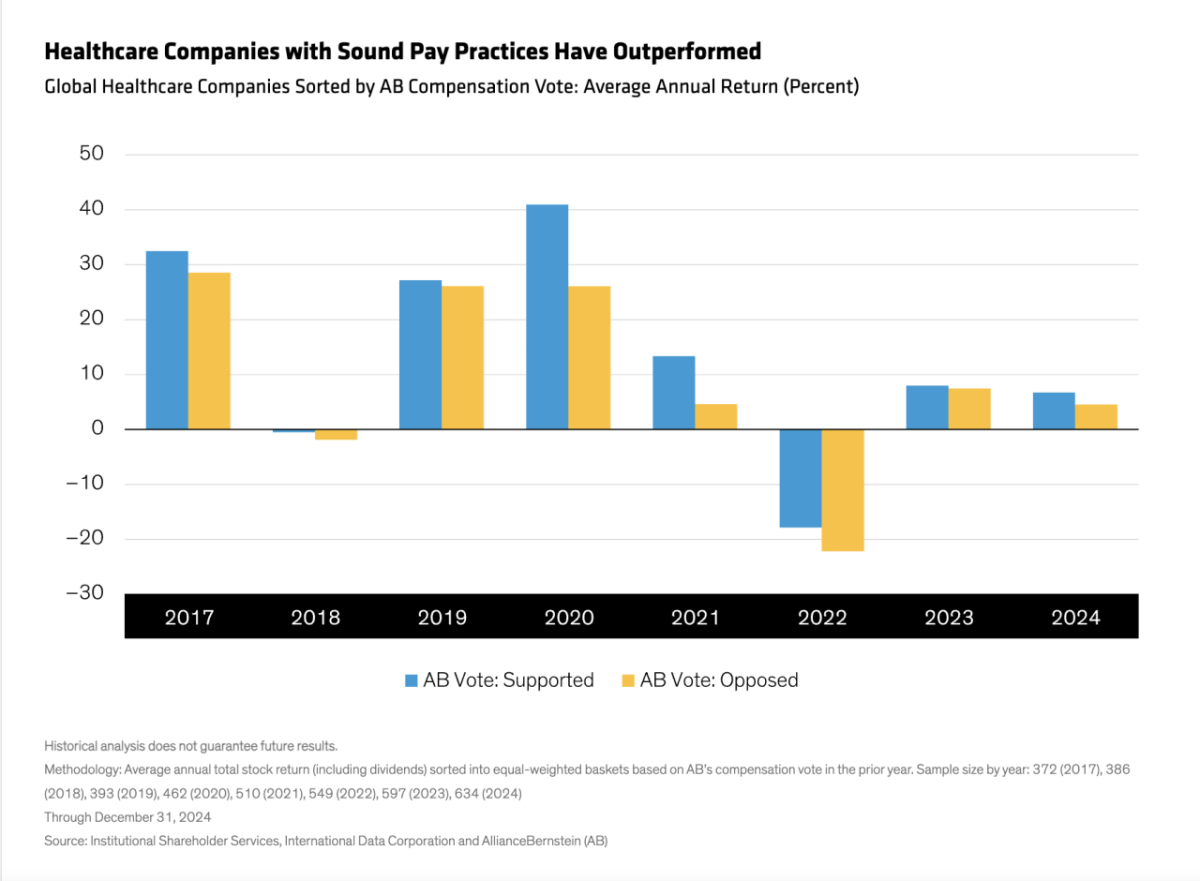

We’ve found that an AB-approved compensation package has been a leading indicator of outperformance for healthcare companies globally. Since 2016, companies with compensation practices we approved of have posted higher average returns the following calendar year versus those we opposed (Display).

Active Ingredients for Good Incentives

Having engaged* with hundreds of healthcare firms on compensation design, we’ve identified three core signs of an effective pay program.

- Equity Alignment: When the company does well, management should do well, and vice versa. For this reason, we keep a close eye on the equity/cash mix of executive pay packages, as well as the length of vesting periods, the robustness of share-ownership guidelines and the presence of clawback provisions. When it comes to managing a long-term pipeline, there’s no replacement for long-term skin in the game.

- Profitable Innovation: Performance-based awards work best when linked to financial and strategic goals geared toward efficiency and innovation. This might include metrics such as operating profit and return on invested capital. For some businesses, research-and-development milestones such as patents or regulatory approvals may also be useful metrics. We prefer goals that reward executives for pursuing long-term value instead of short-term share price hurdles.

- Value Add: Ultimately, we prefer healthcare companies that add value for customers, shareholders and the healthcare system as a whole—with pay packages structured accordingly. This may mean linking pay to goals that capture patient outcomes, cost of care and access to medicine.

A Tough Pill to Swallow: Bad Incentives Persist

Unfortunately, poorly designed pay plans remain a problem across pharma and biotech—from early-stage initial public offerings (IPOs) to well-established players.

For example, many large pharmaceutical companies directly adjust litigation and compliance expenses out of executive compensation calculations. This can result in generous bonuses even in years when stakeholders are adversely affected by legal settlements and penalties that detract from financial performance. Companies may attempt to characterize litigation expenses as legacy concerns, since the alleged damages occurred in the past—or as one-offs, despite multiple occurrences.

We think investors should be particularly wary of these tactics when practiced by firms with recurring product quality and safety issues. Our view on this is simple. If executives can be rewarded for selling legacy products, then they should also be accountable for managing the legal risks.

IPOs, too, may distort incentives. New research from Yale Law School reveals that early-stage biotech firms frequently partake in a practice called pre-IPO option discounting. This involves awarding options to insiders shortly before an IPO, with an exercise price well below the expected IPO price. This risky practice can create an immediate windfall for insiders without any meaningful performance conditions or approval from public investors.

In a sample of more than 100 newly public biotech companies, researchers found that more than two-thirds of these firms awarded discounted options to insiders. On average, recipients enjoyed a discount of 48% off the IPO price.

Of course, there must be incentives to develop new therapies, and we’re in favor of well-structured option grants. But we think pre-IPO option discounting warrants closer scrutiny from investors, as it may create a day-one jackpot for executives and dilution down the road for public investors, regardless of the company’s contribution to the healthcare system.

Compensation as an Investment Consideration

Assessing a company’s executive compensation structure is only one component of fundamental analysis, but in the case of healthcare investing, it has material implications. Healthcare executives effective in improving health outcomes deserve to be rewarded for their leadership, but it’s up to investors to verify.

Active managers can help weed out companies that favor insiders over investors, while prioritizing firms with shareholder-friendly pay practices. Over time, we believe that companies with good incentives will deliver better long-term outcomes for patients and investors alike.

Landon Shea, Associate—Responsible Investing, was instrumental in the research supporting this blog.

*AB engages issuers where it believes the engagement is in the best interest of its clients.

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams, and are subject to change over time.