AllianceBernstein: Carbon Handprints: A New Approach to Climate-Focused Equity Investing

By David Wheeler & Daniel C. Roarty

Investors are strengthening their commitment to help combat climate change. But as inflows to climate-focused funds accelerate, more questions are being asked about the investing approaches of these portfolios.

What type of companies are held in climate-focused portfolios? Can you fully assess a company’s impact on the environment by looking at its carbon emissions metrics alone? And how does a climate-focused fund contribute to global efforts to accelerate decarbonization?

Investors often seek simple metrics to determine which companies are “good actors” in the fight against climate change. The most common metric for evaluating a company’s environmental impact is the carbon footprint—total greenhouse gas (GHG) emissions generated by business activities. But a carbon footprint doesn’t tell the whole story of a company’s impact, and can also be misleading. There are many other ways for companies to promote a transition to a low-carbon world that simply won’t register in carbon footprint data. And there are many ways for companies to lower a carbon footprint that don’t help in tackling climate change.

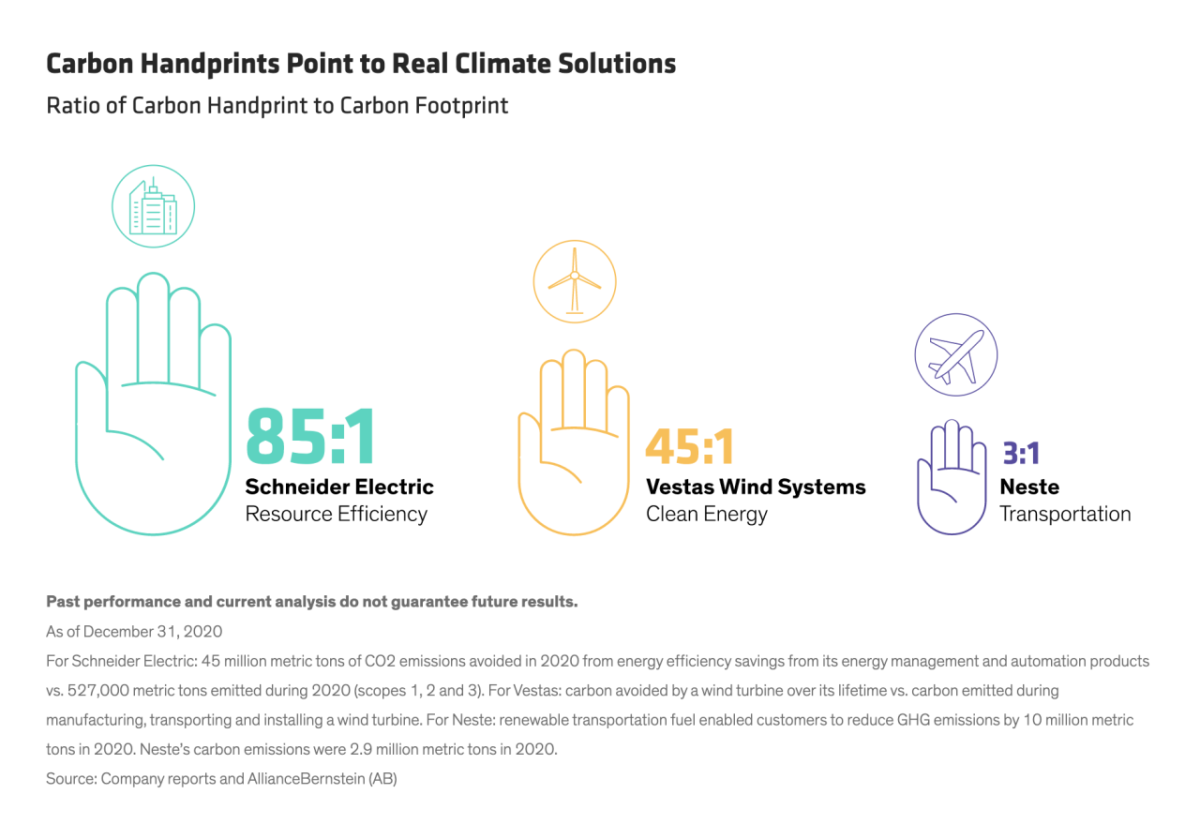

So how can investors gain confidence that an equity portfolio is invested in companies that are really helping to address climate risk? Instead of focusing exclusively on a company’s carbon footprint, we believe investors should look at a company’s carbon handprint. In contrast to a carbon footprint, which measures the negative impact of a company’s operations on the environment, a carbon handprint measures the positive impact, or carbon avoided, by using a company’s products. These products represent the positive solutions to global climate challenges created by a company. From clean energy to recycling, transportation to energy efficiency, diverse companies with a big carbon handprint are making major contributions to solving the world’s climate crisis.

Applying the Carbon Handprint Principle

There are different ways to quantify a carbon handprint for each solution group. But across solutions—among them agriculture, clean energy, transportation and energy efficiency—the unifying principal that anchors our analysis is how much carbon is avoided.

This metric becomes the lens for identifying and evaluating a carbon handprint. For example, clean energy companies will be judged on the amount of zero-carbon energy generated, while resource efficiency companies are ranked on their ability to save energy for other companies and entities.

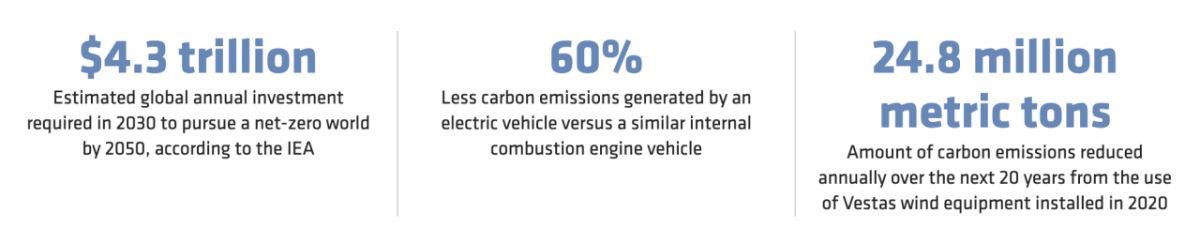

In this paper, we present case studies that show how to apply a carbon handprint analysis. Consider Schneider Electric, a French multinational company that provides energy management systems to help buildings, data centers and industrial facilities reduce their emissions. These technologies helped companies avoid 45 million metric tons of CO2 emissions in 2020—85 times more than Schneider’s emissions during the same year (Display). Vestas Wind Systems, a Danish manufacturer of wind turbines, generated 73,000 metric tons of CO2 through its manufacturing processes in 2020, but will enable its customers to reduce carbon emissions by 45 times more than that annually over the next 20 years.

Disclosure of carbon avoided is not an industry standard. As a result, investors can’t rely on company reports or third-party rating agencies to understand how much carbon is avoided through climate solutions. By actively engaging with management and conducting independent research, we believe investors can obtain the information needed to measure a company’s carbon handprint accurately and convincingly. Establishing a clear carbon handprint metric allows investors to assess how a company is contributing to the fight against climate change, and how its contribution is evolving over time.

Past performance, historical and current analyses, and expectations do not guarantee future results.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

About the Authors

David Wheeler, CFA

David Wheeler is a Portfolio Manager for the Sustainable Climate Solutions Portfolio and Senior Research Analyst for the Sustainable Thematic Equities Portfolios, covering the energy, industrials and materials sectors for the portfolio team. Prior to joining the firm in 2008, he was a managing director, analyst and portfolio manager at Neuberger Berman. Before that, Wheeler worked at J.P. Morgan as a research analyst for the energy sector. He holds a BA in economics from Middlebury College, and is a CFA charterholder. Location: New York

Daniel C. Roarty, CFA

Daniel C. Roarty was appointed Chief Investment Officer of AB's Sustainable Thematic Equities team, which manages a suite of geographically diverse strategies dedicated to the achievement of the United Nations (UN) Sustainable Development Goals (SDGs), in 2013. Since assuming this role, he has become a thought leader in socially responsible investing, utilizing the SDGs as a road map for identifying thematic investment opportunities. Roarty is an active part of the sustainable investing community, acting as a subject-matter expert around the globe, including speaking at the 2018 Sustainable Investing Conference at the UN. He joined the firm in 2011 as global technology sector head on the Global/International Research Growth team and was named team lead in early 2012. Roarty previously spent nine years at Nuveen Investments, where he co-managed both a large-cap and a multi-cap growth strategy. His research experience includes coverage of technology, industrials and financials stocks at Morgan Stanley and Goldman Sachs. Roarty holds a BS in finance from Fairfield University and an MBA from the Wharton School at the University of Pennsylvania. He is a CFA charterholder. Location: Philadelphia