As Large Corporations Go Green, Utilities Are Feeling the Loss

Renewables give big companies greater cost controls, reduced carbon footprints

It’s been a headache-inducing nexus of active regulation, distributed energy and environmentalism for some electric utilities. Plunging costs of solar power and growing concerns of climate change are inspiring swelling ranks of the largest private and Fortune 500 companies pursuing not only aggressive renewable energy goals for sustainability purposes but also cost effectiveness and resiliency.

With that confluence, utilities are facing the sobering question of whether to significantly invest in green infrastructure to keep these large customers and risk controversial rate cases, or watch helplessly as that caravan of large, rate-paying customers defects, taking considerable revenues with it. The latter scenario could inspire other customers to follow suit, raising the prospects of higher bills as significant fixed costs are spread across a smaller population, creating additional financial burden for the end user and lower customer satisfaction for the energy provider.

In this industry long viewed as moving at a glacial pace, often at the speed required by regulation, such pressures should be a pressing clarion call for engagement between utilities and the regulators whose constructs often are lagging behind advances in technology, the growth of alternative generation (renewable energy resources) and customer expectations. The current situation, at a time of growing energy options for businesses, offers electric utilities an opportunity to make the case to would-be defectors, that the existing infrastructure offers power that’s more cost-effective and quicker to market than buildouts of DER.

Renewables Give Big Companies Greater Cost Controls, Reduced Carbon Footprints

Such an ambitious switch to alternative electricity sources can give companies greater

control over their energy costs and bolster their competitiveness. It also can shave their carbon footprints by being emissions-free — a movement that resonates with the public at a time of growing appetite for clean energy and of worries about climate shocks. All of it is against the backdrop of a proliferation of energy-devouring data centers, which exemplify significant load growth and opportunities by developers of such sites to build their own onpremises microgrids or other DER in the pursuit of clean, sustainable energy.

As Black & Veatch’s 2018 Strategic Directions: Electric Report bears out, electric utilities are taking notice. According to a survey of more than 300 industry leaders, nearly half of respondents (48 percent) considered the electric industry’s future as potentially catastrophic if utilities don’t adopt their own alternative energy solutions. Nearly four in 10 said such a gloomy fate awaits if regulatory models preclude market flexibility.

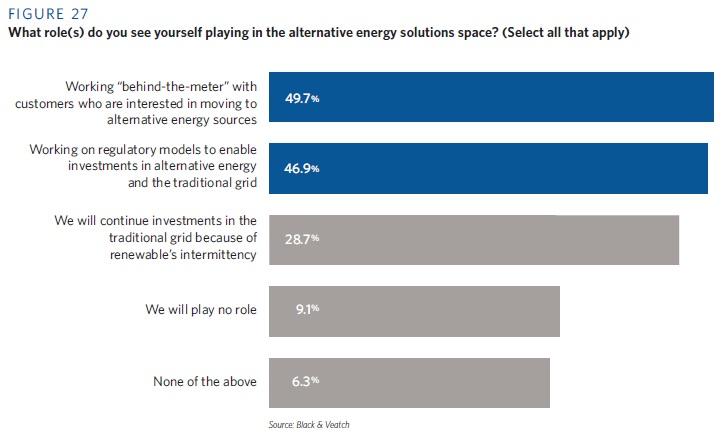

Separately, the survey, which again found reliability at the forefront of the industry’s importance, found that half of the respondents said they see themselves working behind the meter with customers interested in moving to alternative energy sources, followed closely by efforts to secure regulatory models enabling investments in the traditional grid and alternative energy sources (Figure 1).

While some large companies have said they’d power a portion of their operations with renewable energy, many others have insisted they are taking an all-or-nothing approach by installing their own solar arrays, wind farms, energy storage, microgrids and other resources. A “RE100” listing by The Climate Group and CDP (formerly the Carbon Disclosure Project) shows that more than 120 companies have announced plans for their electricity to come entirely from renewable resources as part of a global corporate leadership initiative.

Those moving the needle include some of the corporate world’s most recognizable names and admired brands: Walmart, IKEA, Apple, General Motors, eBay, Procter & Gamble, Facebook, Starbucks, Google and Hewlett-Packard. Heavyweights in banking, insurance and brewing also are creating roadmaps heavily reliant on renewables for their energy futures. Other companies are going the route of Power Purchase Agreements (PPAs) — particularly beneficial in that while they don’t require massive upfront capital investments, they offer the prospect of lower energy costs.

California Leads the Charge with Solar Mandate for New Residences

While navigating their alternative energy options, companies generally consider three legs to the project stool: Does it make economic sense, does it increase reliability and resilience, and does it contribute to the business’ sustainability? Each can drive the decision-making, with many treating microgrids or DER as more of an insurance policy against outages than as a capital project. Timing for these questions is ripe, given the continued decline of the cost of renewables and batteries.

Some states are forcing a faster, sweeping adoption of renewable energy on the residential front. In California, for instance, energy regulators this year passed a new building code requiring most newly constructed, low-rise homes constructed after 2019 to have built-in solarpowered energy systems, making that state the first to adopt such a mandate. That California Public Utilities Commission edict promotes onsite generation and clean energy while launching the state closer to its goal of cutting its carbon footprint in half by 2030.

All the while, California’s chief utility regulator, Michael Picker, warned this year of a potential statewide energy crisis spurred by scores of customers defecting from utilities and getting power from rooftop solar panels, self-generation, community choice aggregators (CCAs) that contract directly with generators, or other nonutility sources. Given the CCAs’ ever-increasing share of California’s power load, Picker’s commission added that as much as a quarter of the state’s energy demand may be sourced outside of utilities by the end of 2018. The commission called on legislators and stakeholders to help tackle challenges confronting the state’s energy future and reliability.

“If California policymakers are not careful, we could drift slowly back into another predicament like the energy crisis of 2001,” Picker said in releasing a report about the state’s “electricity market transformation” and the need for dialogue about it.

California weathered an energy crisis at the start of this century, but “now we are effectively decentralizing and reshaping electric markets through dozens of different decisions and legislative actions,” the commission wrote. “The major conclusion of the research about California’s history and the other jurisdictions studied is that we need a clear long-term vision for our regulatory framework that provides a lasting, stable platform that goes beyond shortterm fixes.”

Across the landscape, utilities are looking to modernize their grid by relying on more renewables — and, in turn, potentially curbing the frequency of defections by green-minded businesses. In Michigan alone, Consumers Energy — the state’s biggest energy provider, with 1.8 million electric customers — announced in June that it will eliminate its use of coal to generate electricity by 2040 and increase its use of renewable resources, from 11 percent now to 43 percent by 2040. The company said “it is seizing a once-in-a-generation opportunity to reshape Michigan’s energy future.”

Still, utilities must sell regulators on the prudency of such investments. Those verseers, after all, watch closely to ensure that ratepayers aren’t paying more than they should and that everyone gets equal access to reliable power.

A similar scene is playing out across the globe, propelled by considerable drops in costs of solar power components in recent years. The International Energy Agency reported in June that investment in new renewables-based power capacity, at $297 billion, remained the largest area of electricity spending in 2016, the last year such figures are available. That outlay, while down 3 percent from the previous year, still outpaced spending on traditional energy sources such as coal, natural gas and nuclear power.

Utilities, Regulators Must Be Proactive In Dialogue

With regulators’ help, utilities must be nimble in making changes that align with growing cleanenergy mandates. Failing to do so could drive away sizable commercial and industrial clients (large electricity consumers) with the financial means to turn to renewables or distributed generation. Those defections from the grid inadvertently would make the system more expensive by spreading its fixed costs among fewer customers and adding to the network’s complexity.

Making a meaningful difference would require profit-driven utilities and the regulators who monitor them to reinvent their dynamic. Utilities must successfully balance what they’re able to do in a bureaucratic framework with being agile enough to adjust to a changing energy landscape. Conversely, regulators must have open minds and a deep awareness of DER trends and the consequences of when utilities are forced to watch from the sidelines as some of their largest customers set new courses.

Black & Veatch has modeled for utilities various scenarios in which they can best make their case to regulators that they should be allowed to amend their business models to serve greenenergy clients without putting their other customers at risk. With outside engineering and consulting, utilities can assess their exposure to and potential fallout from client shifts to renewable energy. That assessment then may be followed by presenting for regulatory consideration a plausible, comprehensive game plan that accounts for assets such as rooftop solar or backup generation.

Rather than wait for regulators to change the rules of the game, utilities are better served by opening a constructive, data-driven dialogue that outlines how they can reliably supply reasonably priced clean energy to both corporate and rankand-file customers. Doing so further cements the utility’s leadership position in front of, and behind, the meter.