2019 TCFD Status Report: Key Takeaways

Originally posted on fsb-tcfd.org

To better understand current climate-related financial disclosure practices and how they have evolved, the Task Force on Climate-related Financial Disclosures (TCFD or Task Force) reviewed—using artificial intelligence technology—reports for over 1,000 large companies in multiple sectors and regions over a three-year period. In addition, the Task Force conducted a survey on companies’ efforts to implement the TCFD recommendations as well as users’ views on the usefulness of climate-related financial disclosures for decision-making. While the Task Force found some of the results of its disclosure review and survey encouraging, it is concerned that not enough companies are disclosing decision-useful climate-related financial information. This could be problematic for financial markets if market participants do not have sufficient information about the potential financial impact of climate-related issues on companies.

2019 Status Report: Key Takeaways

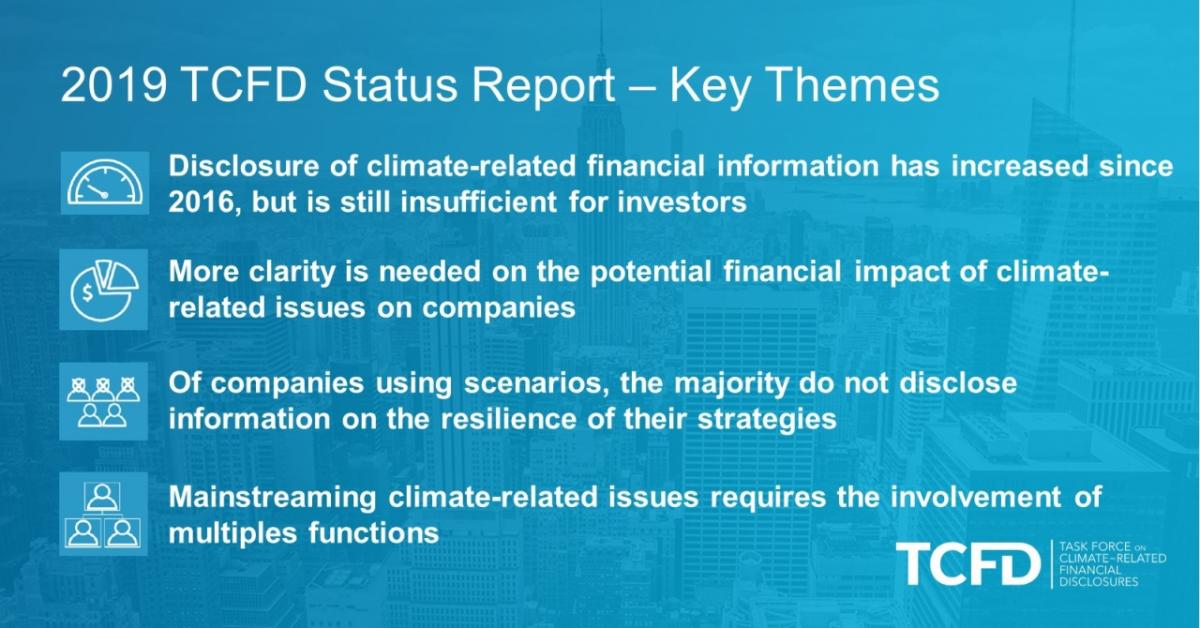

Disclosure of climate-related financial information has increased since 2016, but is still insufficient for investors.Based on the TCFD survey, the artificial intelligence review, and input from external initiatives, the Task Force sees progress being made to improve the availability and quality of climate-related financial information. However, given the speed at which changes are needed to limit the rise in the global average temperature—across a wide range of sectors—more companies need to consider the potential impact of climate change and disclose material findings.

More clarity is needed on the potential financial impact of climate-related issues on companies. The top area identified by users of climate-related financial disclosures as needing improvement is for companies to provide more clarity on the potential financial impact of climate-related issues on their businesses. Without such information, users may not have the information they need to make informed financial decisions.

Of companies using scenarios, the majority do not disclose information on the resilience of their strategies. Three out of five companies responding to the TCFD survey that view climate-related risk as material and use scenario analysis to assess the resilience of their strategies do not disclose information on the resilience of their strategies. This is an important gap in disclosure for companies with material climate-related risks, but it is consistent with the Task Force’s understanding from discussions with various companies, industry associations, and other groups that companies are still early in the process of using climate-related scenarios internally, evolving their approaches, and learning how to integrate scenarios into corporate strategy formulation processes.

Mainstreaming climate-related issues requires the involvement of multiple functions. While sustainability and corporate responsibility functions are the primary drivers of TCFD implementation efforts, risk management, finance, and executive management are increasingly involved as well. The Task Force believes involvement of multiple functions is critical to mainstreaming climate-related issues, especially the involvement of the risk management and finance functions.

Read the executive summary.

Read the full status report.