A Second Round for Circular Sports Gear

By Alexandra Lord and Michelle Meyer

Over the past several years, the circular economy — a system that repurposes rather than discards existing goods — has been gaining momentum, driven by a combination of powerful forces:

- The environment: The circular model keeps waste out of landfills, captures value back into supply chains, and reduces the energy necessary to manufacture new products. As awareness of climate change and environmental risks rises, these product lifecycle considerations are coming to the forefront for consumers.

- Regenerative: The inherent nature of the circular model means it thrives in various forms, from thrift shops, to reuse, to rentals. By connecting buyers and merchants around the world, the internet has expanded resellers’ options and extended their reach beyond local thrifters.

- Economic resilience: For consumers, the upshot is a wider range of high-quality, affordable alternatives to brand-new merchandise. This is proving especially attractive amid turbulence from external factors like higher tariffs on certain imports.

Recently, the Mastercard Economics Institute explored the influence of these forces on the rise of circular fashion. Now, we are turning our focus to a subset of the circular economy: circular sports, or the resale of used equipment.

To isolate the impact of economic and behavioral factors on the circular sports market, we concentrated our analysis on merchants who specialize in used sports equipment, although it is also widely sold at general-purpose online marketplaces and second-hand stores.

Why circular sports makes sense

Sporting equipment is a natural candidate for circular models. For starters much of it is highly durable. With a quick refurbishment, used equipment can look — and perform — almost like new. Furthermore, many of the most avid participants, eager for an edge, will regularly trade up to the latest models, defraying the costs by selling their old equipment to buyers satisfied with last year’s technology.

Also, new athletic gear can be very expensive. For example, to take up golf, you need a set of clubs, golf balls, a bag and appropriate clothing — a significant investment. But what if you discover, after giving it your best shot, that golf just isn’t your game? You could move on with less regret if you’d opted for a set of used clubs instead of investing in brand-new gear.

The benefits of circular sports for children are even clearer. Kids cycle through sports quickly — and they grow fast, requiring frequent gear replacements. Circular options save parents money while allowing kids to experiment with new activities. This could expand opportunities for children in underrepresented economic environments, who currently face greater barriers to participating in sports compared to their more financially included peers: the National Survey of Children’s Health indicates that only 33% of children at or below the poverty line play on a sports team or take lessons, compared to 71% of those in households with incomes at least 400% above the poverty line (about $130k for a family of four).

Tariffs reshape the market

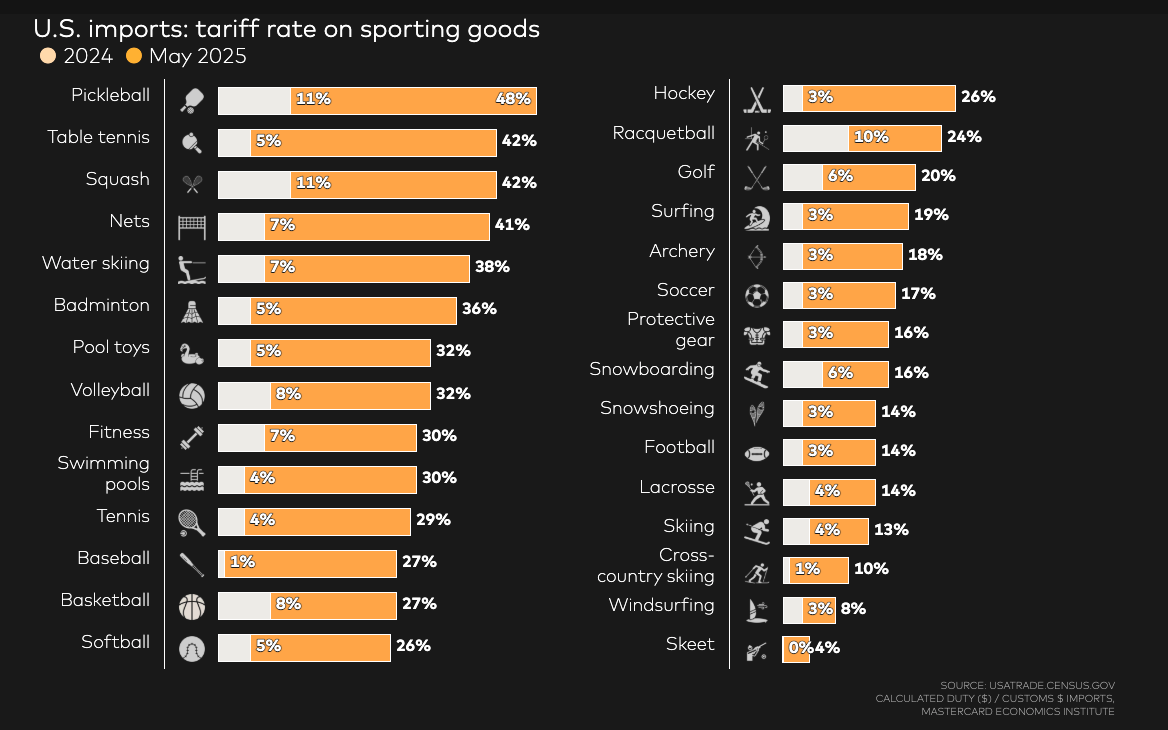

Broader economic factors are also pushing circular sports into the mainstream. The enactment of higher tariffs on many imported sporting goods has raised prices and reduced availability. Sports equipment imported to the U.S. in May were subject to an average tariff rate of 25.8%, compared to 5.5% in 2024, based on official figures (USAtrade.census.gov). While trade negotiations continue, it’s already clear that many sporting products will carry steeper price tags.

In 2024, according to the same source, 56.6% of U.S. sporting goods imports came from China. Taiwan supplied another 12.4%; Vietnam, 9.3%; Canada, 3.4%; Mexico, 3.3%; and Thailand, 2.8%; followed by Italy, South Korea, Czechia and Japan. Together, these countries account for about 92% of U.S. imports of sports and fitness gear. China’s share has steadily fallen from 68% a decade ago; Vietnam has filled in the gap.

As the chart below shows, tariff effects vary significantly depending on the type of sporting equipment. For example, racquet sports are taking a hit: tariffs rates on pickleball and table tennis gear jumped 37% from last year; they now carry tariffs higher than 40%, as do nets and squash racquets. Golf and winter activities like snowboarding and cross-country skiing are less exposed, with tariff rates at or below 20%.

Circular sports sales are picking up speed

Analyzing Mastercard’s aggregated and anonymized transaction data, the Mastercard Economics Institute identified spending trends on used sporting equipment over the past few years.

Key insights:

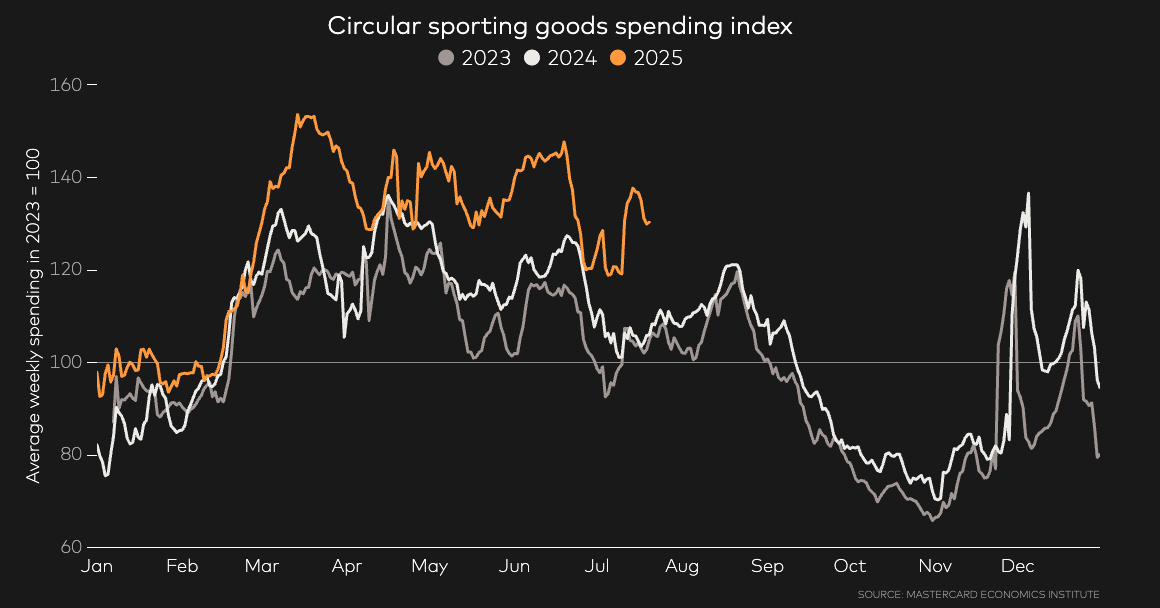

- Momentum is already building: Circular sports sales are up 11% YTD; for comparison, the total sporting goods category grew 3% YTD. After rising 6% in 2024 and 10% in 2023, sales of used sporting equipment are now nearly 30% above 2022 levels.

- Unique seasonal spending spikes: While spending at mainstream sporting goods retailers surges during the holidays, especially on Black Friday and Christmas Eve, activity in the resale sector is more staggered. Peak spending corresponds with the start of schools’ sports seasons in the spring (and fall, to a lesser degree), with baseball gear selling particularly well.

- Demand is highest in Northern U.S.: In 2024–2025, households in Northern U.S. states spent the most on circular sporting goods, with Alaska, Minnesota, Massachusetts, New Hampshire, Maine, Missouri, North Dakota, Vermont and Montana topping the list. What’s driving the trend? High youth sports participation rates in these states fuel demand not only for circular options but for sporting goods overall. When it comes to total sporting goods spend per household, North Dakota, Wyoming, Montana, South Dakota and New Hampshire lead the way.

The final score

The circular sports market is on an exciting trajectory, driven by environmental concerns, economic incentives — particularly tariffs — and changing consumer behavior. Niche specialty platforms to major resale marketplaces are capitalizing on this momentum, offering consumers more affordable — and more environmentally conscious — choices.

As tariffs reshape the economics of new sporting goods, the Mastercard Economics Institute expects the circular share of the market to continue to expand. Within this fertile landscape, new entrants and innovative business models are poised to thrive.