AllianceBernstein - Governance Matters: Don’t Overlook Board Oversight

By Bob Herr and Cem Inal

Director elections can be a powerful tool for investors to weigh in on ineffective boards.

Most conversations around proxy voting focus on shareholder proposals and executive compensation. Meanwhile, the most significant votes tend to fly under the radar: director elections. Boards of directors play a vital role in representing shareholder interests by overseeing a company’s strategic direction, monitoring management and ensuring accountability for the creation of long-term value.

Director-election votes can be a powerful tool for weighing in on material governance issues. Increasingly, investors are doing just that. In the 2024 proxy season, directors who chaired their board’s nominating and governance committees received 5% more dissenting votes on average, reflecting investors’ willingness to hold specific directors accountable for board composition and broad governance concerns.

Beyond conventional governance issues like director independence or shareholder rights, we have leveraged director elections to convey our perspective on issues ranging from product safety and quality to executive compensation to strategic transactions.

A Higher-Quality Board May Bolster Performance

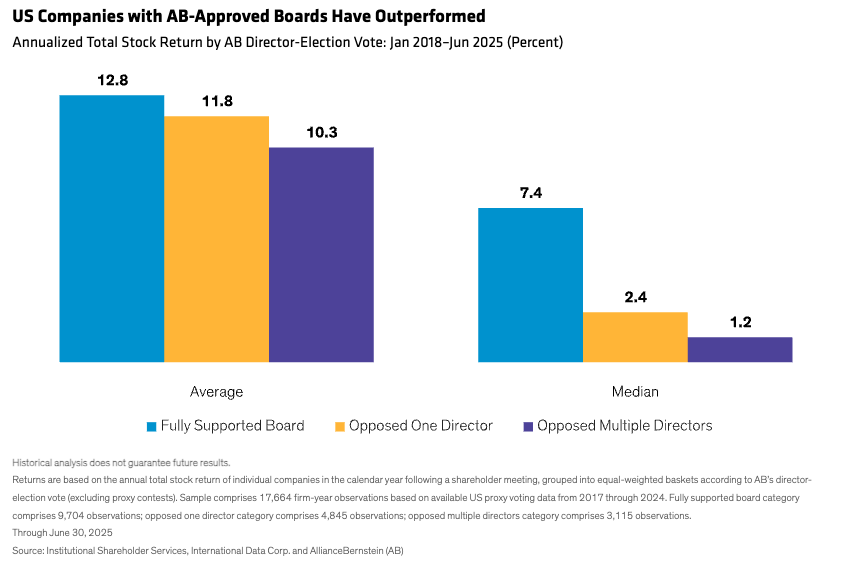

Our votes are always aimed at improving investment outcomes by promoting good governance. While there are countless reasons that a company may underperform its peers, we have found a clear link between our assessment of a board’s effectiveness (as measured by our director votes) and a company’s future stock performance.

Since 2017, US companies with boards warranting our full support have gone on to deliver stronger median and average stock returns the ensuing year (Display). The results show a strong, consistent correlation across nearly all sectors and company sizes. Simply put, when a board doesn’t meet our expectations, it’s generally a leading indicator of underperformance.

What Makes a Board Effective?

The board of directors is critical in overseeing management’s performance, composition and compensation. An effective board is necessary to managing the risks to a company’s operations and financial performance. Directors of public companies are ultimately responsible for ensuring that management acts in the best financial interests of all shareholders. Effective governance is often most visible during corporate turnarounds, where alignment between management and shareholders is essential.

No matter the company or sector, effective boards are defined by their composition, structure and actions. High-quality board composition entails majority-independent oversight, and a variety of skills and backgrounds, without attendance issues or excessive outside commitments. Structural mechanisms such as formal board committees, majority-vote standards and annual director elections ensure accountability. Lastly, boards demonstrate effectiveness through their actions: aligning pay with performance, ensuring disciplined allocation of capital and engaging with shareholders.

Naturally, not all boards meet these criteria. If we determine that a board’s structure or actions aren’t aligned with our clients’ best financial interests, we may hold relevant directors accountable, which is consistent with our fiduciary duty.

How does this work in practice? At a major US bank, we recognized historical governance shortcomings such as fraud, risk-management failures, workplace misconduct and broad misalignment with shareholders. We then engaged* in a multiyear dialogue with its board and senior leaders, consistently voting against relevant directors. Ultimately, the bank implemented improved oversight mechanisms as a part of a larger cultural overhaul, in addition to improving management incentives.

Keep Your Eye on the Board

We believe that investors should stay focused on a simple question: Is the board delivering for shareholders? Our research shows a clear connection: disappointing boards tend to deliver disappointing results, while boards earning our full support historically outperformed in the following year.

Boards perform best when they know investors are watching. Director-election votes may not make headlines, but they’re where investors’ voices matter most.

*AB engages issuers where it believes the engagement is in the best financial interest of its clients.

Landon Shea, Investment Stewardship Associate, and Cole Moore, Investment Stewardship Analyst, contributed significantly to the research for this blog.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.