From the 2022 Fifth Third Sustainability Report: Innovative and Inclusive Products

Fifth Third keeps its customers at the center of everything it does by pairing outstanding customer experience with innovative and inclusive products and services that benefit their lives and improve their businesses.

The Bank is proud of the many products that put its customers in control, offering the features and innovation of a digital-first bank with the security, reliability and local presence of a 165-year-old institution that has remained committed to its communities.

In early 2023, Fifth Third’s innovative culture was recognized with inclusion in Fortune’s inaugural list of America’s Most Innovative Companies. Fifth Third also received the Outstanding Implementation of Digital Customer Experience by a 2022 team award from The Digital Banker.

Enhanced Products and Services for a New Age of Consumer Banking

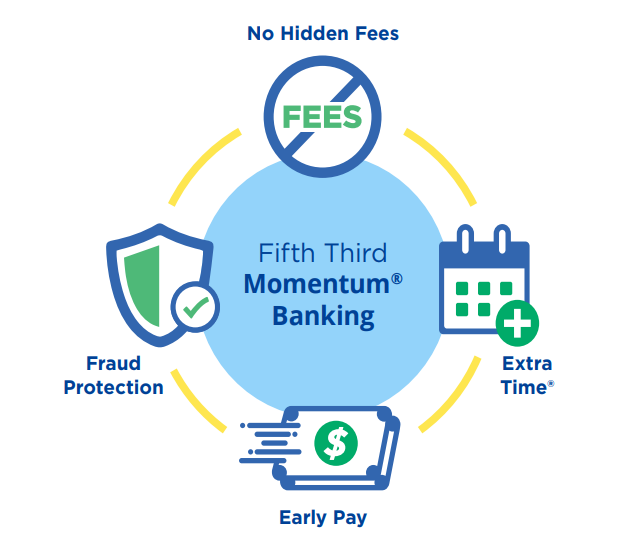

Fifth Third continues to improve its award-winning, flagship Fifth Third Momentum® Banking checking and savings accounts to help customers bank more easily while avoiding frees and having faster access to their money.

Features of Fifth Third Momentum Banking

- The Early Pay® feature gives customers access to their paychecks up to two days early at no cost. In 2022, the Bank expanded the feature to include income received from self employment, also known as gig work, as well as some forms of government and retirement benefits, allowing these customers access to their paycheck up to two days early (following their initial direct deposit). Since its launch in 2021, over 500,000 customer accounts have received their pay up to two days earlier with $27.6 million in paychecks deposited early in 2022.

- Extra Time® gives customers additional time to make a deposit and avoid overdraft fees, up until midnight ET the following business day. With this feature, customers avoided $39.0 million in overdraft fees in 2022.

- MyAdvance® allows customers to advance funds against future qualified direct deposits, starting the month after direct deposit is established. Fifth Third believes this is a more responsible and less expensive option for consumers than check-cashing facilities.

- Smart Savings allows customers to create goals through the Fifth Third mobile app to save small amounts of money automatically. With this product, customers were able to save $25.4 million in 2022 with automatic transfers from their checking to their savings accounts.

- Immediate Funds gives customers instant availability of check deposits (a small fee is incurred).

- Peace of mind with Fraud Protection.

- No Hidden Fees and No Minimum Balance.

- 24/7 Banking Support.

For more information on Fifth Third’s innovative and inclusive products, read the 2022 Sustainability Report.