Taking an Innovative Approach to Credit ESG Analysis

By Terry Ing, Eileen Roche, Jeannie Cho, Paige Whistler, William Needham

Originally published on May 18, 2022

Credit markets may present unique challenges for the integration of environmental, social, and governance (ESG) criteria in investment decisions. At KKR, we have utilized a number of tools to manage ESG considerations within our Credit platform, including a gating issues list focused on identifying business activity risks, and third party risk assessment software to screen for red flags in prospective investments.

Building on KKR’s decade-plus years of experience incorporating ESG criteria into certain investment decisions, over the last couple of years, our credit team has analyzed and explored ways to further enhance our approach. As a culmination of this collaborative effort, which involved inputs from our limited partners, ESG consultants, and cross-functional experts within KKR, we launched “ESG Credit 2.0,” which we believe to be a robust, repeatable and measurable process that is helping us be more proactive and thoughtful in managing ESG issues across our credit portfolios.

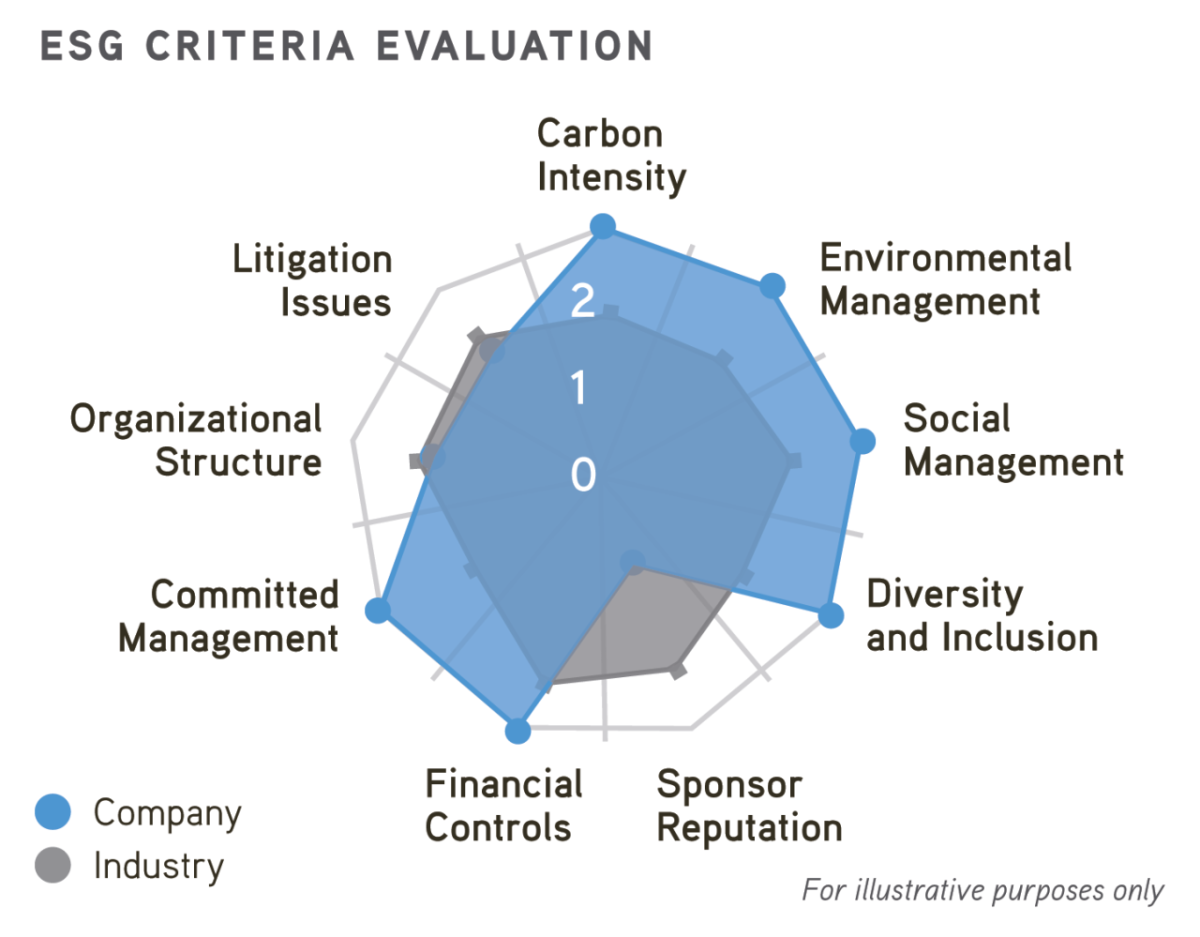

At the core of this process is our “ESG Scorecard,” a proprietary analytical tool that our analysts are now expected to use to evaluate every applicable prospective credit investment. The scorecard is designed to capture information consistently across credits, facilitating our evaluation of the ESG risks and opportunities of applicable investments across both our leveraged and private credit portfolios. To inform the scorecard analytics, more than 160 investment professionals have evaluated more than 1,100 credit investments to date, creating a digital database of ESG due diligence that includes quantitative metrics and qualitative analysis.

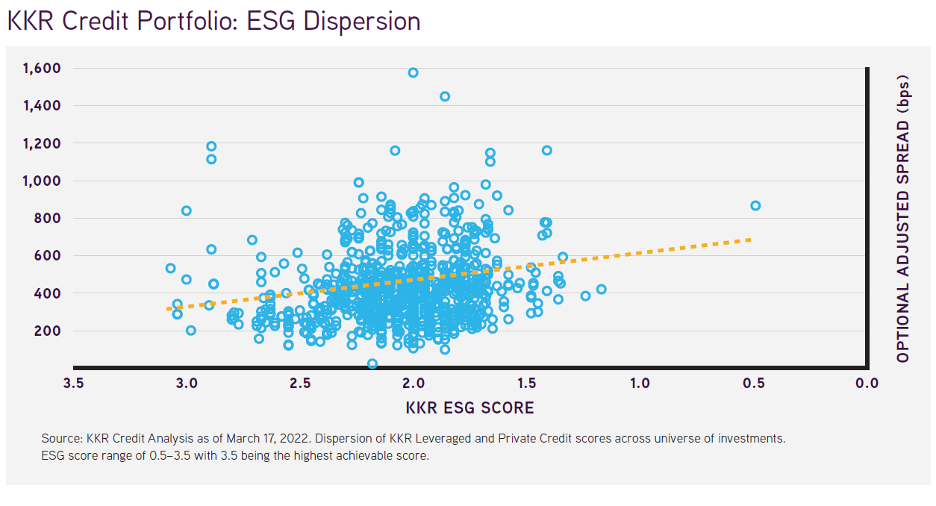

Data from our ESG Scorecard indicate that, in the high yield and bank loan market, companies scoring highly on ESG performance are not being rewarded with lower credit spreads while those with significant ESG concerns are being penalized, trading more than 350 basis points wider than the market on average. We also identified a large amount of dispersion in ESG scoring vs. credit spreads, which is where we see a significant opportunity for credit investing.

We believe that a premium for strong ESG performance will eventually get priced into the leveraged credit market as investors continue to focus more on ESG factors and asset owners put more capital into ESG-focused products. If true, the dispersion that we are currently seeing in ESG scores vs. spread will likely show a pattern akin to what we have seen with the relationship between spreads and credit ratings, with higher scoring credits trading tighter and lower-scoring credits trading wider.

That said, we believe this transition will take time and that we now have a unique and exciting opportunity to identify companies that we believe are high-performing from an ESG perspective but have yet to be rewarded in market dynamics. Our scorecard provides a new layer of analysis that goes beyond the financial metrics that we would traditionally use to assess credit performance, giving us additional insights into why certain companies are likely to struggle or succeed relative to their peers, especially over the long-term. For example, a lack of proactive action around diversity or social issues may not signal an immediate risk to the credit-worthiness of a company, but could point to a weaker corporate culture or lagging practices that have potential to cause problems further down the line.

Still, one of the key challenges that we face is what we believe to be a lack of reliable and quality data on ESG topics. Only 15-40% of issuers in our leveraged credit portfolios are covered by major third-party ESG data providers, and 40% of all credits in our portfolio scored low on ESG-related disclosure, according to our ESG Scorecard. To overcome these limitations, our analysts have been actively engaging with management teams on ESG matters, in addition to manually researching company websites and sending requests to issuers and underwriters. Our hope is that through this active engagement on ESG topics, we can encourage issuers to focus more on managing ESG considerations and disclosing data on ESG performance. We are already seeing the fruits of this engagement begin to appear and we look forward to seeing even more ahead.

We are excited about the future of sustainable credit investing, and aim to continue to evolve and fine-tune our approach as ESG performance demands and regulations change. We are confident that our process positions us well to continue identifying ESG-related risks and leaning into opportunities where we can be an agent for change in the leveraged and private credit markets.

We look forward to sharing more insights and updates on our progress in the future.